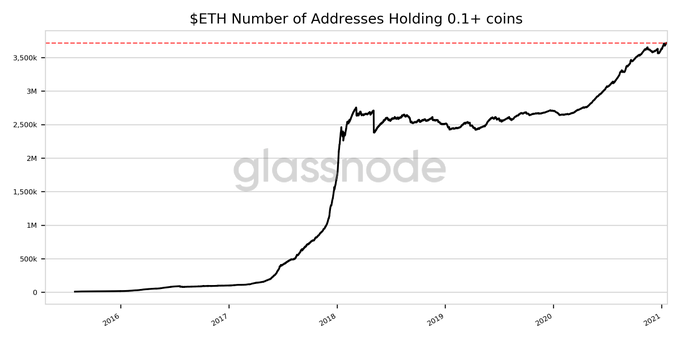

Ethereum Addresses with at least 0.1 ETH Hit All-Time High as Amount Held on Exchanges Drops

Brian Njuguna Jan 18, 2021 10:08

Number of Ethereum addresses holding 0.1+ coins just reached an ATH of 3,716,113, according to on-chain data provider Glassnode.

Pundits, investors, and traders are keeping a keen eye on Ethereum (ETH) as it continues to show budding potential. The second-largest cryptocurrency by market capitalization has been up by 15.54% in the past week and is currently trading at $1,218 at press time, according to CoinMarketCap. This price brings it a lot closer to its record-high of $1,400.

New data by Glassnode reveals that the number of crypto addresses holding more than 0.1 coins has broken a record. The on-chain data provider noted:

“Number of Ethereum addresses Holding 0.1+ coins just reached an ATH of 3,716,113.”

These statistics show that more participants are joining the Ethereum bandwagon as its fame continues to rise in the crypto space. The future looks bright for ETH based on notable developments in its network.

For instance, the launch of Ethereum 2.0 has gained considerable attention in the crypto sector, as Ethereum seeks to transit to a proof-of-stake consensus mechanism, where validation of block transactions is based on the number of ETH held and this approach is deemed more environmentally friendly than mining. Furthermore, a boom in the decentralized finance (DeFi) sector is the icing on the cake for Ethereum.

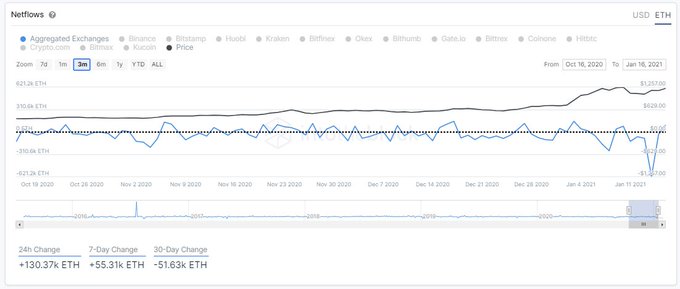

Ethereum in exchanges shrinks

Data by IntoTheBlock, a blockchain analytic firm, shows that Ethereum in exchanges is leaving in droves. For instance, 621,000 ETH recently exited exchanges, which cements the confidence of hodlers.

Notably, whenever coins leave crypto exchanges, they are stored in cold wallets for long-term purposes and this boils down to more faith on the part of whales and other hodlers. This trend may be in anticipation of the fact that Ethereum’s price will go to the moon in the near future.

For instance, crypto analyst Michael van de Poppe recently revealed that ETH price might go ballistic in late 2021. His sentiments are echoed by veteran Wall Street trader Raoul Pal who stipulated that Ethereum’s price might reach $20,000 in price, based on Metcalfe’s Law.

Image source: Shutterstock