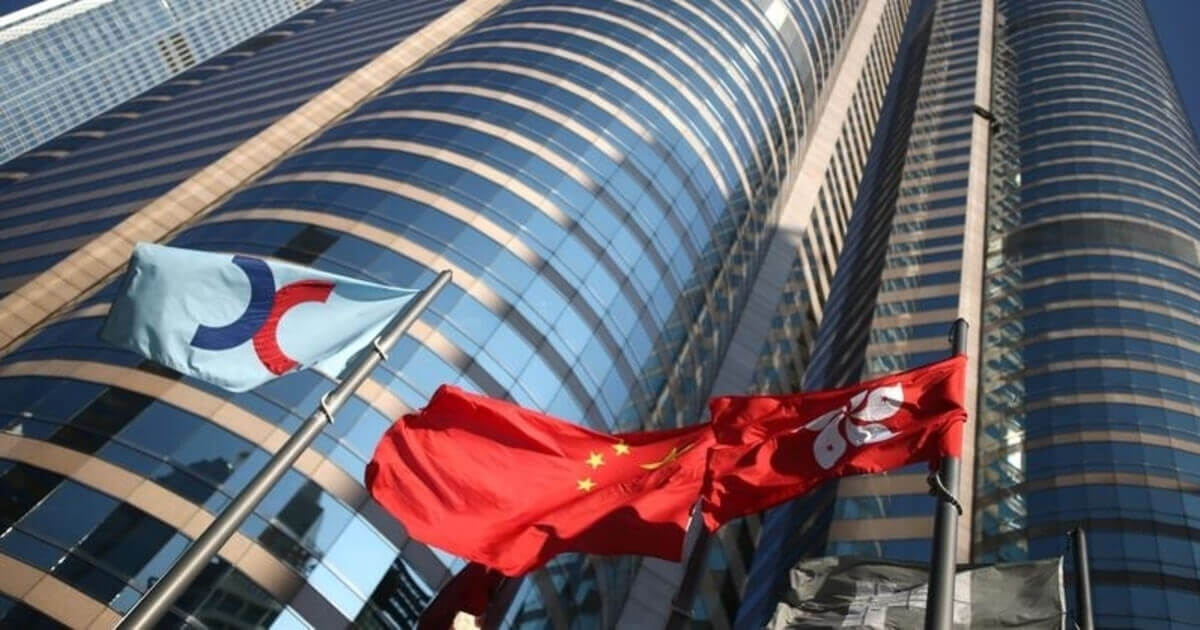

Breaking: London Stock Exchange Rejects £32B Takeover Offer from HKEX

Kun Hu Sep 12, 2019 16:00

Rejection of Conditional Proposal from HKEX

NOT FOR RELEASE, PUBLICATION OR DISTRIBUTION IN WHOLE OR IN PART, DIRECTLY OR INDIRECTLY IN, INTO OR FROM ANY JURISDICTION WHERE TO DO SO WOULD CONSTITUTE A VIOLATION OF THE RELEVANT LAWS OR REGULATIONS OF THAT JURISDICTION

THIS ANNOUNCEMENT CONTAINS INSIDE INFORMATION

FOR IMMEDIATE RELEASE

13 September 2019

Rejection of Conditional Proposal from HKEX

Further to the announcement on 11 September 2019, the Board of London Stock Exchange Group plc (“LSEG”), together with its financial and legal advisers, has now considered the unsolicited, preliminary and highly conditional proposal from Hong Kong Exchanges and Clearing Limited (“HKEX”) to acquire the entire share capital of LSEG (the “Conditional Proposal”).

The Board has fundamental concerns about the key aspects of the Conditional Proposal: strategy, deliverability, form of consideration and value. Accordingly, the Board unanimously rejects the Conditional Proposal and, given its fundamental flaws, sees no merit in further engagement.

LSEG has today sent a letter to HKEX setting out the reasons for its rejection. The letter is set out in the Appendix.

LSEG remains committed to and continues to make good progress on its proposed acquisition of Refinitiv Holdings Ltd (“Refinitiv”). Regulatory approval processes are under way and a circular is expected to be posted to LSEG shareholders in November 2019 to seek their approval of the transaction. The transaction remains on track to close in H2 2020.

Further information:

Media

Gavin Sullivan/ Lucie Holloway

+44 (0)20 7797 1222

newsroom@lseg.com

Investor Relations

Paul Froud

+44 (0)20 7797 3322

This announcement is made on behalf of LSEG by Lisa Condron, the Group Company Secretary of LSEG.

Appendix I – LSEG’s Letter to HKEX

Dear Ms Cha and Mr Li,

We are responding to your highly conditional proposal of 9 September 2019.

We were very surprised and disappointed that you decided to publish your unsolicited proposal within two days of our receiving it.

Having now considered your letter and the associated documents carefully with our financial and legal advisors, the Board has fundamental concerns about your proposal.

The Acquisition of Refinitiv

LSEG agreed and announced the acquisition of Refinitiv on 1 August 2019. This was the culmination of many months of strategy development, deep consideration and discussion. It is a transformational transaction, strategically and financially. The combined global business will be headquartered and domiciled in the UK with a premium listing in London.

The financial and strategic logic of the Refinitiv transaction has been exceptionally well received. Since the Refinitiv announcement, the LSEG share price is up c.29%, a value increase of c.£5.8bn. There is positive market sentiment about the potential for further value creation for the enlarged group and the Board is confident that significantly greater value can be achieved.

Our Evaluation of your Highly Conditional Proposal

1. HKEX Proposal Does Not Meet Our Strategic Objectives

We do not see strategic merit for LSEG in your proposed transaction. Our planned acquisition of Refinitiv meets LSEG’s strategic objectives across its businesses which the Board believes to be critical for a leading Financial Markets Infrastructure provider of the future. In stark contrast, the high geographic concentration and heavy exposure to market transaction volumes in your business would represent a significant backward step for LSEG strategically.

We recognise the scale of the opportunity in China and value greatly our relationships there. However, we do not believe HKEX provides us with the best long-term positioning in Asia or the best listing / trading platform for China. We value our mutually beneficial partnership with the Shanghai Stock Exchange which is our preferred and direct channel to access the many opportunities with China.

2. Serious Deliverability Risk

LSEG provides critical financial markets infrastructure. Your proposal would be subject to full scrutiny from a number of financial regulators, as well as governmental entities under, for example, the UK Enterprise Act, the CFIUS process in the US, and the ‘golden powers’ regime in Italy. There is no doubt that your unusual Board structure and your relationship with the Hong Kong government will complicate matters. Accordingly, your assertion that implementation of a transaction would be “swift and certain” is simply not credible. On the contrary, we judge that the approval processes would be exhaustive and that support from relevant parties, vital for the transaction, is highly uncertain. This would pose a serious risk for our shareholders.

In this context, the consequence of our pursuing your proposal would be the termination of the acquisition of Refinitiv when there is such uncertainty, given the regulatory, shareholder and other approvals you require, that a sale to you would be concluded. In our judgment, this is not a course of action that could be recommended to our shareholders, particularly given the high confidence we have in the significant value creation and deliverability of the Refinitiv transaction.

3. HKEX Share Consideration is Unattractive

We note that three-quarters of your proposed consideration is in HKEX shares, representing a fundamentally different and much less attractive investment proposition to our shareholders. We see the value of your share consideration as inherently uncertain. The ongoing situation in Hong Kong adds to this uncertainty. Furthermore, we question the sustainability of HKEX’s position as a strategic gateway in the longer term. The Hong Kong concentration and core characteristics of your business, together with your Hong Kong domicile and listing, present an additional set of difficulties.

4. Value Falls Substantially Short

Irrespective of the considerations above, and even assuming your proposal were deliverable, its value falls substantially short of an appropriate valuation for a takeover of LSEG, especially when compared to the significant value we expect to create through our planned acquisition of Refinitiv.

Taking all of these factors into account, the Board unanimously rejects your proposal. Given the fundamental flaws in your proposal, we see no merit in further engagement.

Yours sincerely,

Don Robert

Chairman, London Stock Exchange Group plc

Appendix II – Bases of calculation

The LSEG share price increase of approximately 29% has been calculated by reference to the following LSEG closing share prices:

- £56.72 on 26 July 2019, being the last trading date prior to LSEG’s first announcement in relation to its acquisition of Refinitiv;

- £73.22 on 6 September 2019, being the last trading date before LSEG received the Conditional Proposal from HKEX.

The LSEG value increase of approximately £5.8 billion has been calculated by reference to:

- the LSEG closing share prices set out above;

- 349,702,276 LSEG Ordinary Shares in issue (excluding 949,747 Ordinary Shares held in Treasury) as at the close of business on 26 July 2019, being the last trading date prior to LSEG’s first announcement in relation to its acquisition of Refinitiv;

- 349,738,988 LSEG Ordinary Shares in issue (excluding 932,533 Ordinary Shares held in Treasury) as at the close of business on 6 September 2019, being the last trading date before LSEG received the Conditional Proposal from HKEX.

Important notice

Goldman Sachs International (“Goldman Sachs”), which is authorised by the Prudential Regulation Authority and regulated by the Financial Conduct Authority and the Prudential Regulation Authority in the United Kingdom, is acting as lead financial adviser to LSEG and no one else in connection with the Transaction and the matters set out in this announcement. In connection with such matters, Goldman Sachs, its affiliates, and its or their respective directors, officers, employees and agents will not regard any other person as their client, nor will they be responsible to any other person for providing the protections afforded to their clients or for providing advice in relation to the Transaction or the contents of this announcement or any other matter referred to herein.

Morgan Stanley & Co. International plc (“Morgan Stanley”), which is authorised by the Prudential Regulation Authority and regulated by the Financial Conduct Authority and the Prudential Regulation Authority in the United Kingdom, is acting as lead financial adviser to LSEG and no one else in connection with the matters set out in this announcement. In connection with such matters, Morgan Stanley, its affiliates, and its or their respective directors, officers, employees and agents will not regard any other person as their client, nor will they be responsible to any other person for providing the protections afforded to their clients or for providing advice in relation to the contents of this announcement or any other matter referred to herein.

Robey Warshaw LLP (“Robey Warshaw”), which is authorised and regulated by the Financial Conduct Authority is acting as lead financial adviser to LSEG and no one else in connection with the matters set out in this announcement and will not be responsible to anyone other than LSEG for providing the protections afforded to its clients or for providing advice in relation to the contents of this announcement or any other matter referred to herein.

Barclays Bank PLC, acting through its investment bank (“Barclays”), which is authorised by the Prudential Regulation Authority and regulated by the Financial Conduct Authority and the Prudential Regulation Authority in the United Kingdom, is acting as sponsor, corporate broker and financial adviser to LSEG and no one else in connection with the matters set out in this announcement and will not be responsible to anyone other than LSEG for providing the protections afforded to clients of Barclays nor for providing advice in relation to the contents of this announcement or any other matter referred to herein.

RBC Europe Limited (trading as “RBC Capital Markets”), which is authorised by the Prudential Regulation Authority and regulated by the Financial Conduct Authority and the Prudential Regulation Authority in the United Kingdom, is acting for LSEG and no one else in connection with the matters referred to in this announcement and will not be responsible to anyone other than LSEG for providing the protections afforded to clients of RBC Capital Markets, or for providing advice in connection with the matters referred to in this announcement.

Disclosure requirements of the Code

Under Rule 8.3(a) of the City Code on Takeovers and Mergers (the “Code”), any person who is interested in 1% or more of any class of relevant securities of an offeree company or of any securities exchange offeror (being any offeror other than an offeror in respect of which it has been announced that its offer is, or is likely to be, solely in cash) must make an Opening Position Disclosure following the commencement of the offer period and, if later, following the announcement in which any securities exchange offeror is first identified. An Opening Position Disclosure must contain details of the person’s interests and short positions in, and rights to subscribe for, any relevant securities of each of (i) the offeree company and (ii) any securities exchange offeror(s). An Opening Position Disclosure by a person to whom Rule 8.3(a) applies must be made by no later than 3.30 pm (London time) on the 10th business day following the commencement of the offer period and, if appropriate, by no later than 3.30 pm (London time) on the 10th business day following the announcement in which any securities exchange offeror is first identified. Relevant persons who deal in the relevant securities of the offeree company or of a securities exchange offeror prior to the deadline for making an Opening Position Disclosure must instead make a Dealing Disclosure.

Under Rule 8.3(b) of the Code, any person who is, or becomes, interested in 1% or more of any class of relevant securities of the offeree company or of any securities exchange offeror must make a Dealing Disclosure if the person deals in any relevant securities of the offeree company or of any securities exchange offeror. A Dealing Disclosure must contain details of the dealing concerned and of the person’s interests and short positions in, and rights to subscribe for, any relevant securities of each of (i) the offeree company and (ii) any securities exchange offeror, save to the extent that these details have previously been disclosed under Rule 8. A Dealing Disclosure by a person to whom Rule 8.3(b) applies must be made by no later than 3.30 pm (London time) on the business day following the date of the relevant dealing.

If two or more persons act together pursuant to an agreement or understanding, whether formal or informal, to acquire or control an interest in relevant securities of an offeree company or a securities exchange offeror, they will be deemed to be a single person for the purpose of Rule 8.3.

Opening Position Disclosures must also be made by the offeree company and by any offeror and Dealing Disclosures must also be made by the offeree company, by any offeror and by any persons acting in concert with any of them (see Rules 8.1, 8.2 and 8.4). Details of the offeree and offeror companies in respect of whose relevant securities Opening Position Disclosures and Dealing Disclosures must be made can be found in the Disclosure Table on the Takeover Panel’s website at www.thetakeoverpanel.org.uk, including details of the number of relevant securities in issue, when the offer period commenced and when any offeror was first identified. You should contact the Panel’s Market Surveillance Unit on +44 (0)20 7638 0129 if you are in any doubt as to whether you are required to make an Opening Position Disclosure or a Dealing Disclosure.

Rule 26.1 disclosure

In accordance with Rule 26.1 of the Code, a copy of this announcement will be available (subject to certain restrictions relating to persons resident in restricted jurisdictions) at www.lseg.com by no later than 12 noon (London time) on the business day following the date of this announcement. The content of the website referred to in this announcement is not incorporated into and does not form part of this announcement.

Rule 2.9 information

In accordance with Rule 2.9 of the Code, LSEG confirms that, as at the date of this announcement, that its issued share capital consists of 350,671,521 ordinary shares of 6 79/86 pence each (‘Ordinary Shares’) and 932,533 Ordinary Shares held in Treasury. The total number of voting rights in LSEG is, therefore 349,738,988. The International Securities Identification Number for the Ordinary Shares is GB00B0SWJX34.

General

Please be aware that addresses, electronic addresses and certain other information provided by LSEG shareholders, persons with information rights and other relevant persons for the receipt of communications from LSEG may be provided to HKEX during the offer period as required under Section 4 of Appendix 4 of the Takeover Code to comply with Rule 2.11(c).

Image via ShutterstockImage source: Shutterstock