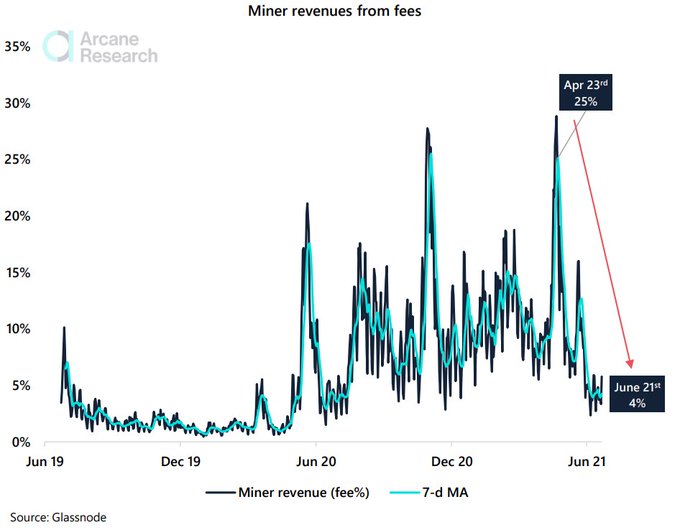

Bitcoin Transaction Fees as a Percentage of Total Miner Revenues Hit Lowest Point Since June 2020

BTC transaction fees have plunged based on the ongoing Chinese crackdown on Bitcoin mining facilities.

Bitcoin (BTC) was down by 2.26% in the last 24 hours to hit $33,259 during intraday trading, according to CoinMarketCap. However, the ongoing Chinese crackdown on BTC mining facilities has dragged its upward momentum, given that some Bitcoin miners have been selling their holdings to attain the needed capital to establish new facilities in other nations.

As a result, BTC transaction fees have plunged. Analytic firm Arcane Research explained:

“Bitcoin transaction fees as a percentage of total miner revenues are now at the lowest since June last year, even with the decline in hashrate and less frequent blocks.”

Reportedly, Bitcoin on-chain transactions recently nosedived to a two year low of 8,843.054, as China’s crypto mining restrictions triggered FUD (fear, uncertainty, and doubt) among investors.

Bitcoin needs to break through $35K

According to market analyst Michael van de Poppe:

“Bitcoin rejects the crucial barrier here. Breaking through $35K would mean continuation to $38.5K and maybe $41K. Rejecting here means - looking for a higher low to confirm bullish divergence. Levels to watch; $33K and $31.5K.”

The analyst stated that the $31.5K was vital because a higher low is needed to be created so that it could trigger a bullish divergence.

A bullish divergence occurs when prices fall to a new low while an oscillator fails to reach a new low. This situation demonstrates that bears are losing power and that bulls are ready to control the market again.

Michael van de Poppe had previously noted that if the $31.5K didn’t get the support, a further drop to the $24K area would happen.

Meanwhile, The Bank for International Settlements (BIS) recently announced its full support for developing central bank digital currencies (CBDCs) in pursuing financial and monetary stability through international cooperation with the mandate and support by central banks.

CBDCs are digital assets pegged to a real-world asset and backed by the central banks, meaning that they represent a claim against the bank exactly how banknotes work. Furthermore, they are blockchain-enabled, representing a new technology for issuing central bank money at the wholesale and retail level.

Image source: Shutterstock