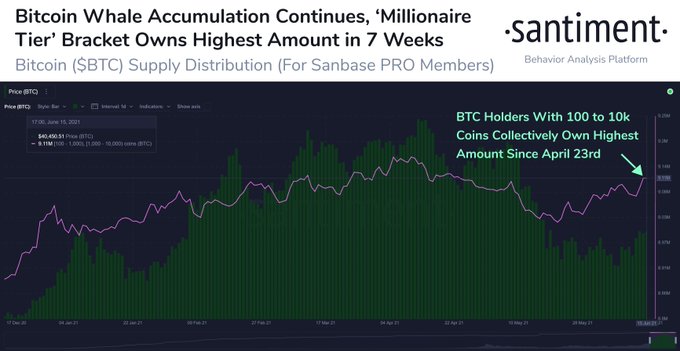

Bitcoin Addresses Holding Between 100 and 10,000 BTC Hit a 7-Week High

BTC addresses holding between 100 and 10,000 BTC have been on a spending spree, given that they have added 90,000 BTC to their portfolio, as acknowledged by on-chain metrics provider Santiment.

Bitcoin (BTC) was still standing at the $40k psychological level to trade at $40,046 during intraday trading, according to CoinMarketCap.

BTC addresses holding between 100 and 10,000 BTC have been on a spending spree, given that they have added 90,000 BTC to their portfolio, as acknowledged by Santiment. The on-chain metrics provider explained:

“Bitcoin addresses holding between 100 to 10,000 BTC have accumulated 90,000 more BTC in the last 25 days. They now hold a 7-week high of 9.11m BTC, currently worth a total of $366.89Billion at this time, and 48.7% of the total Bitcoin supply.”

Therefore, Bitcoin whale addresses hit a 7-week high as they continue accumulating more coins.

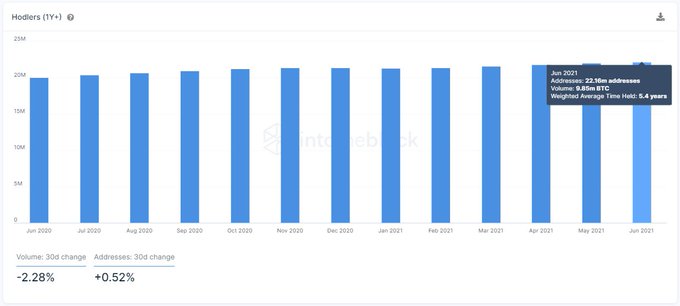

Bitcoin long-term holders are the true “diamond hands”

BTC long-term holders have shown their firm stand of keeping their coins regardless of market turbulence, as alluded to by IntoTheBlock. The crypto data provider noted:

“Bitcoin long-term holders are the true "diamond hands". YTD, the number of addresses holding BTC for more than one year has increased by 3.9%. 22.16 million addresses or roughly 58.52% of the total Bitcoin Holders are holding 9.85m BTC for more than 1 year.”

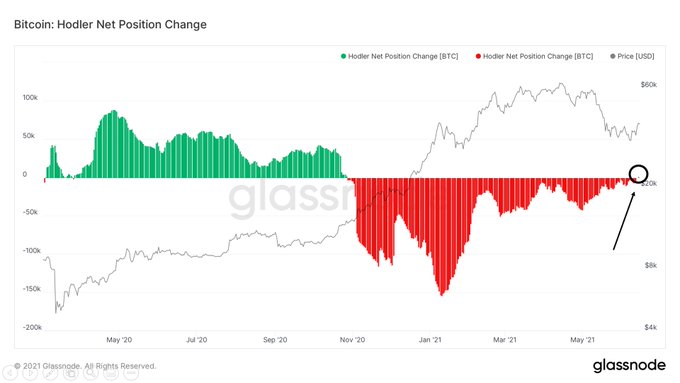

These sentiments were affirmed by on-chain analyst William Clemente III who stated that holder net position change flipped green for the first time since October 2020.

He had previously acknowledged that long-term BTC holders were stacking while short-term ones were selling.

Bulls are still not in charge

Market analyst Lark Davis believes that Bitcoin bulls are not yet dominated the market because the top cryptocurrency failed to close above the 200-day moving average (MA) despite being a stone’s throw away.

Davis recently stated that Bitcoin needed momentum to hit $43,000 for it to retake the 200-day MA.

The 200-day MA is a key technical indicator used to determine the general market trend. It is a line that shows the average closing price for the last 200 days or roughly 40 weeks of trading. Therefore, a surge above it represents the start of an uptrend.

Image source: Shutterstock